The year of 2020 has been a time of tumultuous change, resulting in many dramatic shifts in consumer outlook, attitudes and behaviors. As time has passed, and with no assurance that anything resembling a status quo is on the near-term horizon, keeping a close watch on how brand advertising is working in-market has become more important than ever. In fact, amidst all the change, it’s no longer clear that what resonated and drove brand success in the past still works.

As these seismic shifts in our world have continued unabated, it is increasingly difficult to sort out what changes in brand attitudes and behaviors are being driven by external events and which are being influenced – positively or otherwise – by advertising. Without understanding this, advertisers struggle to know whether to continue with the same ads and campaigns, pivot to new messaging, or to pull back entirely and put the funds allocated to advertising to use elsewhere.

A number of advertisers have discovered the value of longitudinal design research during these tumultuous times. Having proved to be an effective approach in earlier times of tumult, including both 9/11 and the Great Recession, longitudinal advertising research is perhaps even more of a differentiator in 2020 than ever before. Those who employ this design gain the kinds of insights that are empowering them to weather the storm far better than competitive brands that are being swept along without a strong compass to guide future actions.

The longitudinal approach involves interviewing the same individuals at two points in time; it’s also critical to have the means to accurately determine what specific ads each person has actually seen (not just been exposed to) in-market between the two interviews. This design provides the ability to separate the changes in brand KPIs that were caused by advertising versus those that were driven by the external marketplace dynamics that were at play during the time that has elapsed between interviews.

Some examples from product categories in which purchasing has been lifted by pandemic-related issues and, conversely, some for which the pandemic has caused purchasing to slow are illustrative. We all know by now that certain categories are weathering 2020 well, some even growing, on the basis of shifting behaviors. Examples that come readily to mind include cleaning products, grocery products that enable home cooking, beer brands for home consumption, home exercise equipment, along with a whole host tech brands that enable remote work and communication. If you are marketing a brand in one of these categories and watching overall sales increases, what is the appropriate role for advertising? Should you pull back? After all, you don’t need ads to drive sales right now. Or should you lean in – working to both build share and ensure brand strength coming out the other side?

During the first several months of the pandemic, we employed the longitudinal design approach for two brands that had been experiencing significant sales gains. Both brands – Brand A and Brand B – maintained their advertising presence, both with the dual intent of gaining share during the period and building brand resonance in ways that would benefit the brand in the longer term.

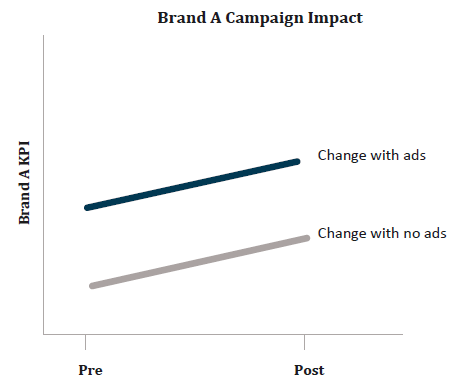

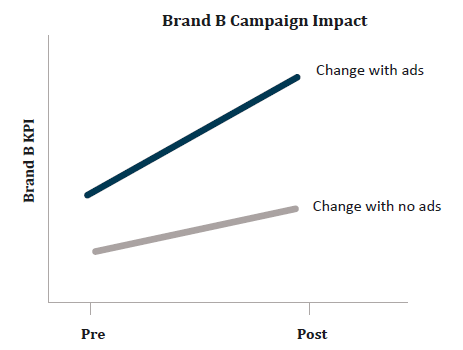

When isolating changes in brand attitudes and future purchase intentions among those who had seen each brand’s campaign from the changes that occurred among those who didn’t see the brand’s ads during the same period, the two brands showed significantly different patterns, with the differences largely attributable to the strength of the specific advertising messages employed by each.

For Brand A, increases in brand KPIs were present overall, as would be suggested by marketplace dynamics. However, the increases were no greater among those who had seen the campaign than among those who hadn’t. As such, it was clear that the brand was riding the wave of marketplace dynamics, but the brand’s advertising campaign was not playing a significant role.

For Brand B, in contrast, while increases were clearly evident among those who didn’t see the campaign (reflecting the marketplace dynamics), increases in brand perceptions and future purchase intentions were far greater among those who had seen the brand’s campaign. In this case, the advertising amplified the growth from marketplace dynamics, helping the brand to achieve greater success than would have been the case in the absence of advertising.

The implications of the insights for these two brands couldn’t be more divergent. For Brand A, through analysis of accompanying in-market advertising resonance data, we were able to dig deeper to provide insights into why the advertising wasn’t persuading; optimization strategies were implemented to improve the persuasive impact of the campaign as the year wore on. For Brand B, the recommendation was to stay the course, and perhaps even double down on the advertising investment to both gain short term share of market and to position the brand to capitalize longer term on the stronger position it’s in the process of building.

Alternatively, brands that are in categories that have been hurt by the shifting marketplace dynamics have as much, if not more, to gain from this type of analysis. It’s a tough call to continue to advertise when overall sales are soft. Consumers may not be buying as much in your category as they were pre-pandemic, but depending on the category, going dark and losing that share of mind may be the worst thing you can do. How do you know what would happen if you went dark?

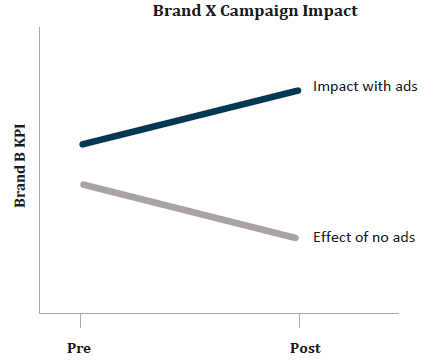

Brand X , is in a category that has shown significant deterioration in sales velocity as a result of behavioral changes connected to the pandemic. The company that owns Brand X, having learned important lessons about the importance of advertising during previous downturns, has made the difficult decision to maintain its advertising budget.

Longitudinal results clearly prove that this strategy is working. While overall sales velocity was down, consumers who have engaged with the brand’s campaign have maintained their rate of purchasing and future purchase intent at nearly pre-pandemic levels. Without advertising, the brand would be in far worse shape than it is. Furthermore, those who have seen the brand’s campaign are showing increases in brand affinity metrics – suggesting that the brand will come out of the current conditions stronger than ever.

The point: If you’re concentrating on overall sales trends, supplemented with attribution modeling, traditional brand tracking and possibly even exposed vs unexposed methodologies, you are very likely to be missing what’s really going on. Your advertising may be working harder than you think – or it may be serving to exacerbate a bad situation. Conversely, even if sales are strong, you might be mis-attributing these sales gains to advertising that isn’t working to propel the brand ahead, thus squandering the opportunity to build toward long term market share gains.

Longitudinal design research is a straightforward, non-black-box based approach that can help your brand navigate tumultuous times and come out ahead – no matter how long these times of change dominate the horizon.